[ad_1]

GQG Partners stock (ASX:GQG) Shares fell sharply today after UBS downgraded the company from “buy” to “neutral” and lowered its price target from $3.30 to $2.30.

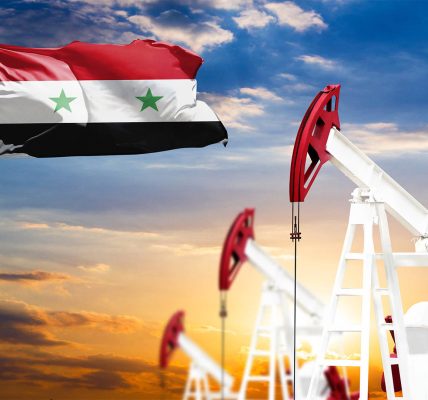

GQG is a US-based global investment management firm specializing in equities with significant holdings in emerging market companies.

The downgrade comes as GQG faces increased scrutiny over its exposure to Adani Group. GQG made billions of dollars from investing in Adani shares following reports of short selling in early 2023. As of Nov. 19, GQG’s stake in Adani group companies was worth $9.7 billion, or about 6.1% of its total assets under management.

However, the next day, the US filed bribery charges against Adani founder Gautam Adani and senior executives. Based on a memo GQG sent to investors, UBS estimated that GQG may have lost $600 million of its funds in the two days following the indictment.

Adani suspect

Adani Group, one of India’s largest conglomerates, operates across sectors such as energy, ports, airports, and logistics. Subsidiaries include Adani Green Energy, a renewable energy company;

On November 20, Indian billionaire Gautam Adani and seven other senior executives were arrested in connection with a US$250 million bribery scheme to win lucrative solar energy contracts in India. He was charged in federal court in Brooklyn.

The defendants are said to have paid bribes to Indian government officials to secure contracts with potential profits of more than $2 billion. Prosecutors allege that Mr. Adani and his associates misled U.S. investors and financial institutions by concealing these practices while raising billions of dollars through loans and bond issues. Detailed evidence was presented, including electronic communications and financial analysis.

Charges include conspiracy to violate the Foreign Corrupt Practices Act, securities fraud, wire fraud, and conspiracy to obstruct justice.

Adani Group denied the allegations and called them “baseless.”

Gautam Adani said, “In today’s world, negative opinions spread faster than facts, and as we move through the legal process, we would like to reaffirm our absolute commitment to world-class regulatory compliance.” I think so.”

market reaction

GQG shares closed 14.04% lower at $2.02 today, even as UBS analysts said they were “generally satisfied” with the company’s Adani-related investment performance.

Meanwhile, Adani Green Energy, which is at the center of the allegations, hit a year-to-date low of INR 898.55 on November 26, but has since recovered to INR 1,326.70, up 38.93% in the past five days. .

[ad_2]