[ad_1]

U.S. President Joe Biden’s recent decision not to run for re-election in November, instead endorsing Vice President Kamala Harris for the Democratic vote, is likely to have markets scrutinizing the new presumptive candidate’s priorities in the coming weeks, according to investment executives.

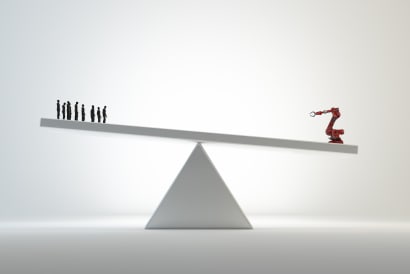

Last month, after the first presidential debate between Biden and former US President Donald Trump, the called “Trump trade” has gained traction, suggesting that industries such as fossil fuels and cryptocurrency could emerge as potential winners with a Trump presidency.

In a market note on Tuesday, Chris Igoe, chief investment officer, core investments at AXA Investment Managers, described the Republican policy agenda as “interesting” reading, with policy proposals suggesting a mix of “trade protectionism, deregulation, fiscal generosity, anti- green energy and social conservatism”.

==

==

With this, investors looking for opportunities in the world's largest economy can identify potential Trump deals in oil and gas industries, artificial intelligence, cryptocurrency and industries that will benefit from protection, such as autos, and deregulation, such as pharmaceuticals products, he explained.

Speaking to InvestorDaily, Betashares Chief Economist David Bassanese outlined that Trump trades could include higher U.S. bond yields and a potentially stronger U.S. dollar, based on the view that the presidential candidate will run a larger budget deficit and will cut taxes.

A potential Harris win, however, "could be the opposite of that," he said.

“In terms of the macro perspective, this is not a tax cut […] so that would mean lower bond yields, maybe a softer U.S. dollar, and the opposite of Trump's deals," Bassanese said.

"On a micro perspective, the biggest difference between the two candidates is the green energy policies." Trump is for fossil fuels and oil, while Democrats are for continued investment in solar and wind power.

According to the executive, Harris remains "a bit of an unknown force."

"I think the markets will be watching carefully over the next few weeks what she prioritises." We don't really know much about her," he said.

"She's obviously been under Biden's shadow for a long time, so we'll see what she prioritizes, but in some ways you're probably going to get less fiscal stimulus with her, certainly less tax cuts and more transition focus towards green energy rather than investing in the oil sector as under Trump.

Global X product and investment strategist Mark Jocum also believes markets are likely to learn more about Harris' political platform as the weeks unfold, telling InvestorDaily it's hard to tell if it will mirror incumbent President Biden's policies. .

U.S. oil and gas stocks are likely to be hit given its tougher stance on these types of companies, he said.

"It's much more supportive of green energy companies, so green and clean energy companies involved in this can benefit," Jocum said, adding that there could be strong support for electric vehicles through tax credits that were established through Inflation Reduction Act in 2022

Looking at technology, which has been one of the best performers in international equity markets in the last financial year, he acknowledged that uncertainties remain about how a Harris administration would approach the sector.

“There may be ongoing regulatory scrutiny on these companies — Harris is a little more pro-competitive, which can affect big tech — but many of the biggest tech firms in the world are also based in her home state of California, so it's hard to say how it will go," he said.

Additionally, there remains an element of hedging to consider in a potential Harris gain. That, he said, could have "a lot of impact" for Australian investors with US stocks in their portfolios.

"If Trump does get on board, it's likely that a lot of the reforms that are going to happen could lead to an appreciation of the U.S. dollar, which would be good for unhedged stocks," Jocum said.

“Whereas if Harris comes in, he might not experience the same level of appreciation.

"If there is a depreciation of the US dollar and a rise in the Australian dollar, especially if the US Federal Reserve intends to start cutting interest rates and the Reserve Bank of Australia raises interest rates, that is likely to benefit hedged investments."

Navigating volatility

Looking ahead, Jocum noted that market volatility could emerge in the months leading up to November. However, the U.S. economy is "doing pretty well" and election-related market moves appear short-lived, he said.

"We've seen 13 consecutive quarters in the U.S. where corporate profit margins exceeded 12 percent," he pointed out.

Also, in terms of historical trends, "every time there's been an election in the U.S., the stock market has returned a positive return of about 11-12 percent," he said.

"So it really doesn't mean the election is going to have a drastic impact on the stock market over the long term, given that there are other factors like interest rates."

Betashares' Bassanese also urged investors not to be "overly concerned" about volatility. Instead, he identified the macroeconomic picture of interest rates, inflation and economic growth as key considerations for investors in US markets.

"I don't think so [the elections] are as important as what happens with US monetary policy and the macro picture," he said, adding that market volatility could actually continue beyond November, depending on the outcome of the election.

"Before the election maybe there is a risk of instability, but certainly immediately after if the result is close.

"There is a risk, as we have seen now in several elections, of this extended period of uncertainty as different outcomes are subject to lawsuits," Bassanese said.

He cited disputes over election results that have been seen in the past, such as calls for a recount in the presidential race between George W. Bush and Al Gore in 2000. and more recently in the 2020 election, when then-President President Trump made efforts to overturn the result.

"There is a risk of several days, if not weeks, of uncertainty," Bassanese said.

[ad_2]